The spirit of change

France has long been an evolving market for tequila. Historically, it has been associated primarily with “mixto” tequilas, found largely in supermarkets and on-trade channels. For many years, tequila in France was linked to accessible private-label brands, often enjoyed in the well-known “tequila paf” shots with salt and lime. While this approach made tequila widely recognized, it also shaped perceptions in a way that did not fully highlight its depth and craftsmanship, particularly among Boomer and Generation X consumers—two groups with a strong appreciation for quality spirits and fine gastronomy. It is important to remember that these are the same two generations that helped establish France as the world’s leading market for single malt whisky in terms of value.

In recent years, the French market has also seen a growing interest in traditional Mexican agave spirits. This pre-pandemic wave of introductions was driven by a variety of new importers eager to showcase these spirits’ artisanal appeal. While this movement brought traditional these spirits into the spotlight, their introduction was at times fragmented – to say the least- making it challenging to build sustained consumer enthusiasm. The on-trade sector played an essential role in raising awareness, but establishing an entire category requires broader industry collaboration, particularly in a market where major players like Pernod Ricard, La Martiniquaise, LVMH, Diageo, and Campari have a significant presence.

As a result, brand recognition and consumer engagement with agave spirits in France remain in development. Ideally, a structured introduction—starting with high-quality tequila, followed by other traditional Mexican spirits such as raicilla ,sotol, and Bacanorra—could have provided a more solid foundation for category growth. However, there is still great potential to refine the approach and enhance the presence of these spirits in the market.

So, how can we further elevate the perception of tequila and raicilla in France?

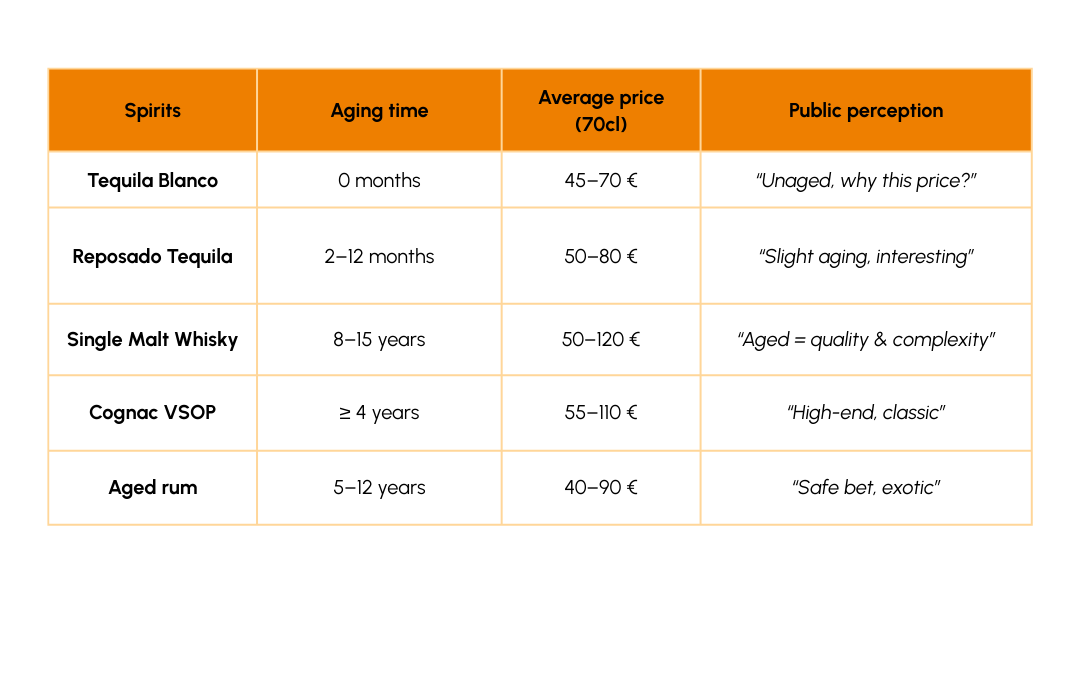

First and foremost, price positioning should be carefully considered to align with market expectations. Currently, 100% agave tequilas—particularly blanco and aged expressions—are often priced similarly to or above premium aged spirits like rum, single malt whisky, and cognac. Consumers naturally compare the value of spirits based on factors such as aging time, and it can be challenging to understand why a blanco tequila, which undergoes virtually no barrel aging, or a reposado with only a few months in wood, is positioned at the same level as a spirit aged for many years in complex cask systems. While the extended growth cycle of agave (five to seven years compared to one year for grain or sugarcane) is a key differentiator, it is not always an immediately persuasive factor for consumers unfamiliar with tequila’s production nuances. Moreover, industry professionals recognize the differences in labor costs and production expenses between Mexico and Western Europe, further shaping pricing discussions.

Beyond pricing, storytelling and education are essential. While the U.S. market has embraced tequila’s rich cultural heritage—thanks to strong communication efforts and the proximity of American travellers to Mexico—European consumers have not yet been engaged to the same extent. There is an opportunity to go beyond the familiar imagery of Frida Kahlo and Día de los Muertos motifs and instead highlight the depth of Mexican terroir, traditions, and craftsmanship in a way that resonates with European audiences.

Spain, with its linguistic and cultural ties to Mexico, has been one of the first European markets to develop a stronger connection with agave spirits. However, the Spanish market is still largely focused on affordable spirits, with consumption patterns that lean toward mixed drinks and shots. While Spain is making progress in premiumization, the broader European market requires a strategic approach to build long-term value for tequila and traditional Mexican agave spirits.

The key to success in Europe lies in shifting from a push strategy to a pull strategy. Rather than simply introducing more brands and innovative packaging, the focus should be on building demand through education, cultural appreciation, and thoughtful investment. European consumers, particularly in France, Italy, Spain, Switzerland, and Germany, have a deep understanding of terroir, agriculture, and aging processes—whether in wine, whisky, or cognac. Tequila producers, by working together, can effectively communicate the unique qualities of their spirits in ways that connect with this existing appreciation for craftsmanship and origin.

Now is the time to take action. The recent tequila boom in the U.S. has provided the industry with valuable momentum, and reinvesting some of these gains into European market expansion will be crucial. A coordinated effort—leveraging tourism, industry partnerships, media engagement, social platforms, spirits fairs, tastings, and cultural festivals—can help position tequila and traditional Mexican agave spirits as premium, culturally rich spirits. Influencers, local ambassadors, and media campaigns should be used to elevate awareness and appreciation across Europe.

The future of Mexican spirits should not be solely reliant on the U.S. market. While the American consumer base has been instrumental in tequila’s growth, long-term sustainability calls for diversification. Europe, with its historical ties to Mexico and deep-rooted appreciation for artisanal products, represents an exciting and promising opportunity. By strengthening the narrative and fostering deeper connections, tequila and traditional Mexican agave spirits can continue to evolve and thrive in the global spirits landscape.

Dimitri Pérez