Korean Alcohol Market and the Evolution of Tequila

South Korea experienced rapid economic growth after the Korean War, which led to industrial concentration. This characteristic is also reflected in the alcohol market. As of 2023, the total size of South Korea’s alcohol market is estimated at around 10 trillion KRW, with green-bottled soju and light lager beer produced by major corporations accounting for 80% of the market. In downtown areas during the evening, it’s common to see many people enjoying soju and beer.

Past Drinking Culture and Health Issues

In the early 2000s, corporate culture in South Korea was dominated by frequent company dinners and business entertainment, which fostered a heavy drinking culture. As a result, the proportion of liver disease patients among South Korean men in their 40s was the highest in the world. This led to South Korea achieving world-class expertise in liver transplant technology. Despite being a country with high alcohol consumption, most of the consumption was concentrated on domestic products, with foreign alcohol limited to beer, wine and whiskey.

Introduction of Tequila to Korea and Its Early Image

Western spirits began entering Korea in the early 1900s, but Tequila is believed to have been introduced in the 1990s. At that time, its primary consumers were young people who watched American movies, and Tequila was perceived as “a drink made from cactus.” Even today, many people struggle to distinguish between cactus and Agave.

Initially, Tequila imports were limited to inexpensive products in small quantities. For those who enjoyed it, Tequila was seen as a magical drink that “makes the next day disappear.” Since lime wasn’t commonly imported at the time, people paired Tequila with lemon and salt while taking shots, often suffering from severe hangovers afterward —giving Tequila a reputation as a “scary drink.”

Changes in Tequila Market and Cocktail Culture

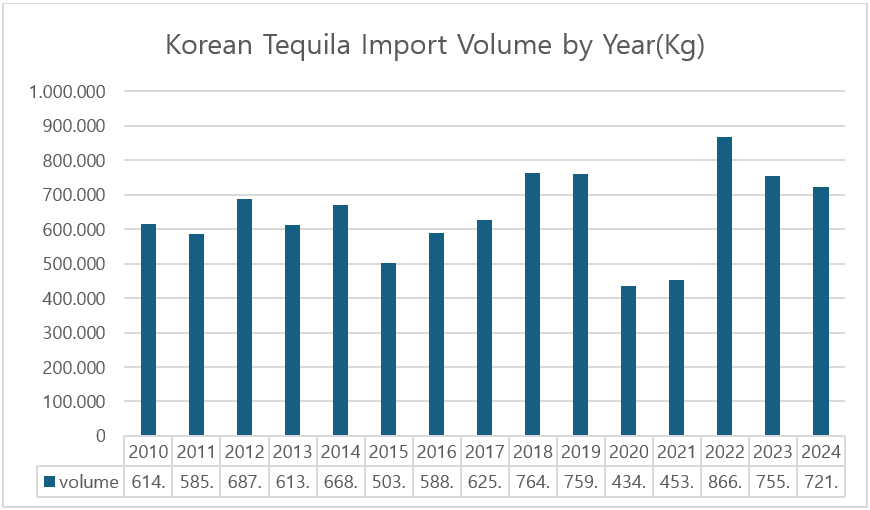

From 2010 onwards, Tequila imports gradually increased but remained limited to only a few varieties. In 2015, during my participation as a judge at Spirits Selection by CMB, I met Hayashi Ikuma, president of the Japan Tequila Association. He mentioned that Japan imported over 1,000 types of Tequila —a number that surprised me since Korea had only about 3–4 brands available at the time.

Eventually, cocktail culture began spreading across Korea. Drinks like margaritas and other Tequila-based cocktails gained popularity, leading to an increase in both import volume and value. Young people who traditionally enjoyed soju and beer started drinking Tequila at clubs, creating new consumption trends.

The Impact of COVID-19 on Drinking Culture

The COVID-19 pandemic brought strict regulations to bars and restaurants in Korea. Tables had to be spaced farther apart, and no more than two people were allowed per table. Group gatherings and company dinners disappeared entirely. Consequently, new drinking trends emerged —home drinking (home sool) and solo drinking (hon sool), where people drank alone at home or invited close friends over.

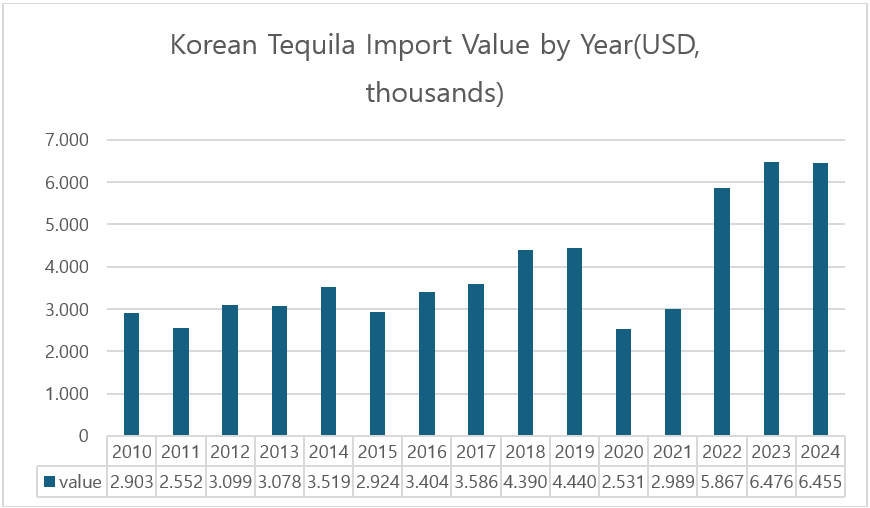

This shift transformed South Korea’s drinking culture from heavy consumption to savoring alcohol itself. Particularly among Millennials and Gen Z (MZ generation), there was a trend toward saving money to buy one high-quality bottle instead of consuming cheap soju or beer. This change led to an increase in imports of premium Tequila and the introduction of educational programs related to Tequila. Celebrities also contributed by introducing premium Tequilas through YouTube channels.

Currently, there are 33 Tequila brands and 133 products being imported into Korea.

Current Trends and Future Prospects

As of 2023, while Tequila import volumes have decreased compared to 2022, import value has increased due to a focus on premium products. However, there is no guarantee of sustained growth for Tequila in Korea. Consumer preferences can shift rapidly —as seen with premium single malt whisky and bourbon whiskey losing favor recently while cheaper standard Scotch whiskys dominate consumption.

For Tequila to become more widely accepted in Korea, efforts must be made to provide consumers with educational opportunities about Tequila and introduce Mexican food culture alongside other aspects of Mexican traditions.

Seongwoon Yoo